Whatever you save now can reduce what you may have to borrow for future expenses.

But reducing college debt is not the only reason to plan. Children with some form of college savings are seven times more likely to attend college.1

The DC College Savings Plan makes it easy to plan for college. Knowing your options and setting your goals are essential to creating an effective college savings plan. In this section, you'll learn:

- How even small contributions on a regular basis can compound over time

- The myths and realities of 529 college saving

- How much you might need to save for college.

Make your plan automatic.

To make the most of your time horizon and the power of compounding, consider putting college savings on autopilot through recurring contributions or payroll direct deposit.2

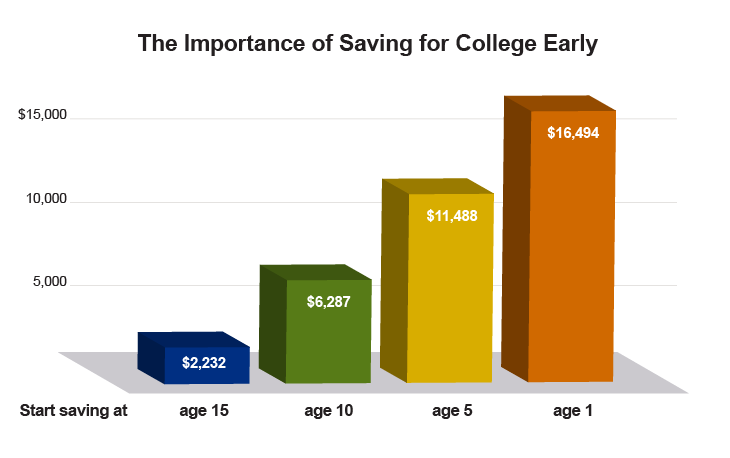

For example, open a DC College Savings Plan account with $25, then save $25 or more on a regular basis. The sooner, you start, the more you could save, as the chart below shows:

As you can see in this hypothetical chart, if an account owner began to save $50 a month when a child was 1 year old (with an initial contribution of $250), a 529 college savings plan could potentially have an account worth $16,494 by the time the child was college age.2

1The Role of Savings and Wealth in Reducing "Wilt" between Expectations and College Attendance. George Washington University, January 2010.

2A plan of regular investment cannot assure a profit or protect against a loss in a declining market.

3The hypothetical example assumes college begins at age 18 and is based on a 5 percent rate of return compounded daily, and is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or taxes, if any, payable upon distribution.