It is a simple way for parents and grandparents to save money for college or post-secondary vocational school. The DC College Savings Plan is sponsored by the Government of the District of Columbia.

What can you use a 529 plan for?

- College and universities, graduate programs, vocational and trade schools, or an apprenticeship that is registered and certified with the Secretary of Labor

- Room and board

- Computers and laptops

- Books and other tools, if required by the school.1

- K-12 tuition expenses at a private, public or parochial school (up to $10,000 per year per student.) For more info, click here

These are considered qualified expenses, so withdrawals to pay for such items can be made tax-free.1

Are there other special advantages of a 529 Plan?

Plenty, including:

- Special tax deductions for DC taxpayers2

- Tax-deferred investment growth

- Gift- and estate-tax benefits

- Low investment fees, and more.

Where can you use your 529 savings?

Money from a DC College Savings Plan can be used for qualified expenses at eligible colleges, universities and vocational schools worldwide, not just in DC.3

What makes a 529 plan so different?

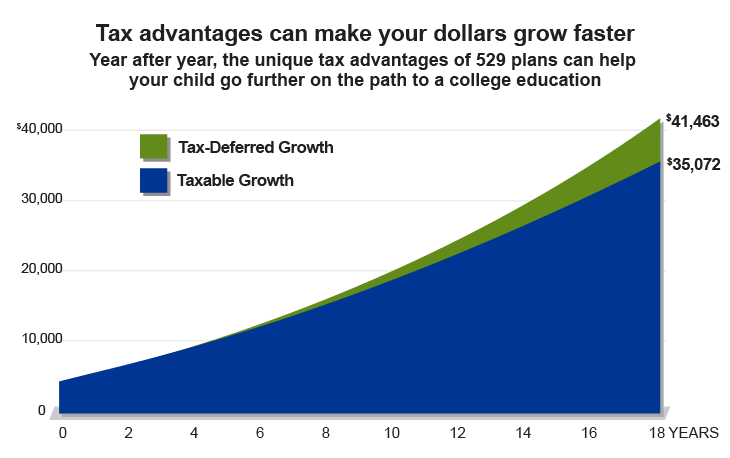

Unlike taxable college savings vehicles, 529 contributions grow free of federal and District taxes.1 The difference can be significant, as shown in the chart below.

If you open a 529 account with an initial investment of $2,500 and contributed $100 every month for 18 years, there could be over $6,300 more for a qualified distribution than the same investment in a taxable account.1

Assumptions: $2,500 initial investment with subsequent monthly investments of $100 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; and taxpayer is in the 30% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical example is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes payable upon distribution.

1Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes and recapture of DC tax deductions. Tax and other benefits are contingent on meeting other requirements and certain withdrawals are subject to federal, state, and local taxes.

2DC taxpayers who contribute to the DC College Savings Plan can deduct up to $4,000 in Plan contributions from their federal adjusted gross income each year on their DC tax return (up to $8,000 for married couples or domestic partners filing jointly if both own accounts).

Contributions by DC taxpayers in excess of the annual limit can be carried forward and deducted in future years on their DC tax return. If a participant makes a non-qualified withdrawal or a transfer/rollover to another state's program within two (2) years of opening the account, the amount of the deduction is "recaptured" and must be included in the participant's District of Columbia income.

Check with your tax advisor to see how 529 plans are treated for income tax purposes.

3An eligible institution is one that is eligible for federal financial aid programs.